XRP Price Prediction: Can ETFs and Technicals Drive a Breakout?

#XRP

- Technical Resistance: 20-day MA at 2.3761 is a critical level for bullish confirmation.

- ETF Catalysts: $2.94B daily inflows predicted from 12 ETFs, but price impact lags.

- Market Sentiment: Mixed; bullish long-term targets ($10) contrast with near-term technical hurdles.

XRP Price Prediction

XRP Technical Analysis: Key Indicators to Watch

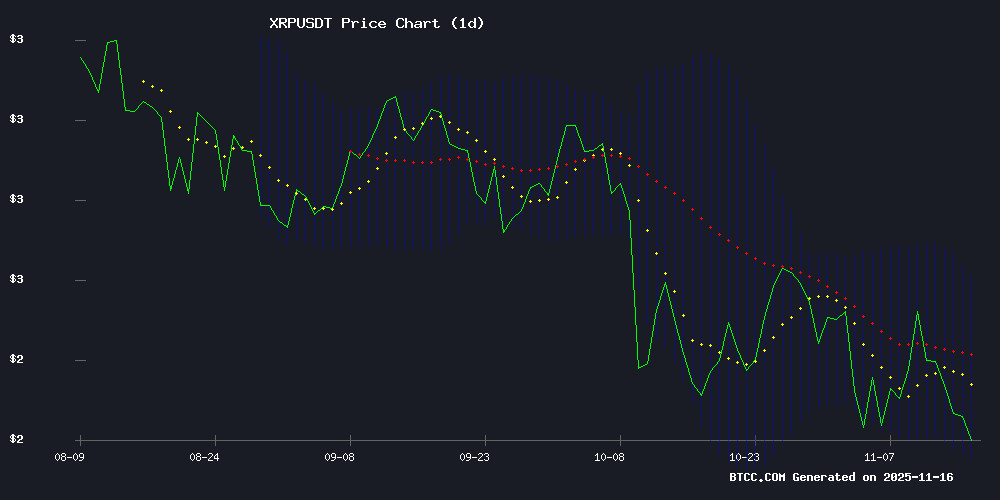

According to BTCC financial analyst Ava, XRP is currently trading at 2.2389 USDT, slightly below its 20-day moving average (MA) of 2.3761. The MACD indicator shows a bullish crossover with values at 0.1238 (MACD line), 0.0831 (signal line), and 0.0407 (histogram). Bollinger Bands suggest a potential reversal if the price holds above the lower band at 2.1321, with the upper band at 2.6200 acting as resistance.

XRP Market Sentiment: ETF Inflows and Institutional Interest

BTCC financial analyst Ava highlights the surge in XRP ETF activity, with Franklin Templeton and other firms entering the market. Despite strong ETF debuts, the token price has yet to reflect this demand. Key support levels and bullish predictions, including a potential $10 target from Canary Capital CEO, are driving optimism. However, Ava cautions that technical resistance at 2.3761 (20-day MA) must be breached for sustained upside.

Factors Influencing XRP’s Price

XRP ETFs Surge as Franklin Templeton and Other Firms Enter Market

The XRP market is experiencing unprecedented institutional adoption with nine exchange-traded funds set to launch within a single week. Canary Capital's XRPC ETF debuted on November 13, achieving $58 million in first-day volume - the largest ETF launch of 2025.

Franklin Templeton's entry signals mainstream validation, with its $1.5 trillion asset base poised to attract significant capital flows. The EZRP ETF launch on November 18 represents a watershed moment for cryptocurrency investment products.

European firms 21Shares and CoinShares follow closely with November 21-22 launches, while Bitwise targets institutional investors with its November 20 offering. This concentrated rollout demonstrates accelerating demand for regulated crypto exposure.

Key Support XRP Price Must Hold for a Potential Reversal

XRP faces a critical juncture as traders watch for a decisive hold above key support levels. The digital asset's recent price action reflects heightened volatility, with liquidations exacerbating market swings.

Chart analysis reveals a tense standoff between buyers and sellers. A sustained defense of current levels could pave the way for a meaningful rebound, while failure may invite further downside pressure.

Mike Novogratz Praises XRP as One of Few Cryptocurrencies to Achieve Monetary Status

Galaxy Digital CEO Mike Novogratz has singled out XRP as a rare success story in the cryptocurrency space, acknowledging its unique evolution into a form of money. "XRP has achieved something really, really complicated in crypto: becoming money," Novogratz stated in an interview with CoinDesk.

The endorsement from one of crypto's most prominent institutional figures highlights XRP's growing recognition as a functional digital asset. While most tokens struggle to find real-world utility, XRP's adoption for cross-border payments and banking partnerships appears to be bearing fruit.

Ripple CEO Says It’s Finally Happening For XRP: Details

Ripple CEO Brad Garlinghouse has highlighted his long-standing anticipation for institutional engagement with XRP-based investment products. The announcement follows the debut of the first-ever spot-based ETF tied to XRP, launched by Canary Capital and now trading on a U.S. exchange.

Market participants are closely watching this development, as institutional adoption could signal broader acceptance of XRP in traditional finance. The ETF's launch marks a significant milestone for the token, which has faced regulatory hurdles in recent years.

Expert Predicts $2.94B Daily Inflows from 12 XRP ETFs

Market analysts project a seismic shift in crypto investment flows as Canary Capital's XRP ETF (XRPC) sets a bullish precedent. The inaugural pure spot XRP fund's strong debut has sparked calculations that a dozen similar products could collectively attract $2.94 billion in daily inflows.

This forecast draws direct parallels to XRPC's launch performance, suggesting institutional appetite for XRP exposure may far exceed current market expectations. The ETF model, proven with Bitcoin and Ethereum products, now demonstrates its scalability to alternative digital assets.

XRP ETF Sees Strong Debut but Fails to Lift Token Price

The Canary Capital XRP ETF (XRPC) attracted $245 million in inflows on its first trading day, defying expectations with $26 million in volume within the initial 30 minutes. Bloomberg ETF analyst Eric Balchunas had previously underestimated the product's potential demand.

Despite the ETF's robust performance, XRP's market price remained stagnant. This disconnect highlights ongoing investor skepticism about the token's fundamentals despite growing institutional accessibility. Market participants appear to be weighing regulatory uncertainties against the ETF's strong debut metrics.

XRP's Million-Dollar Dream: A Distant Prospect or Imminent Reality?

XRP investors are clinging to the hope of turning modest holdings into life-changing wealth, with some projecting a path from $5,000 to $1 million. Such aspirations hinge on the cryptocurrency achieving triple-digit valuations—a scenario that would require unprecedented market adoption and regulatory clarity.

The token's stagnant performance since its 2018 peak contrasts sharply with these bullish expectations. While Ripple's partial legal victory against the SEC removed immediate existential threats, institutional adoption remains the missing catalyst for such exponential growth.

Canary Capital CEO Sees $10 XRP as 'Achievable' Amid ETF Demand Surge

Canary Capital's spot XRP ETF (XRPC) launched with record-breaking first-day trading volume of $59 million, surpassing previous highs. Founder Steven McClurg highlighted XRP's unique position as a payments-focused network, contrasting it with Bitcoin and Ethereum. The XRP Ledger's efficiency in low-cost, rapid transactions positions it as a solution for global remittance challenges.

McClurg tempered community speculation about extreme price targets, labeling projections of $1,000 or $10,000 as unrealistic. However, he acknowledged $10 as a potentially achievable long-term valuation, contingent on sustained institutional adoption through vehicles like the new ETF.

XRP Price Surge Predicted as ETFs Seek Retail Holdings

An XRP community analyst forecasts a significant price rally for the digital asset, arguing that institutional players like ETFs will need to drive valuations higher to accumulate meaningful retail holdings. The prediction follows the launch of Canary Capital's XRP ETF (XRPC) and anticipation of competing products entering the market shortly.

Market participants are closely monitoring how these institutional vehicles might impact XRP's liquidity dynamics and price discovery mechanisms. The cryptocurrency's historical volatility and regulatory clarity position it uniquely among altcoins for structured product adoption.

Is XRP a good investment?

BTCC analyst Ava suggests XRP presents a mixed outlook. Below is a summary of key metrics:

| Metric | Value | Implication |

|---|---|---|

| Current Price | 2.2389 USDT | Below 20-day MA (bearish) |

| MACD | 0.0407 (histogram) | Bullish momentum building |

| Bollinger Bands | 2.1321–2.6200 | Range-bound with breakout potential |

While ETF inflows and institutional interest (e.g., Novogratz's endorsement) are positive, Ava notes that XRP must reclaim 2.3761 to confirm a trend reversal. Retail demand could fuel short-term gains, but volatility remains a risk.